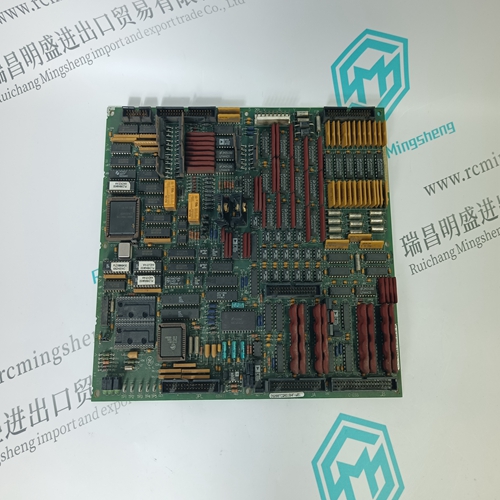

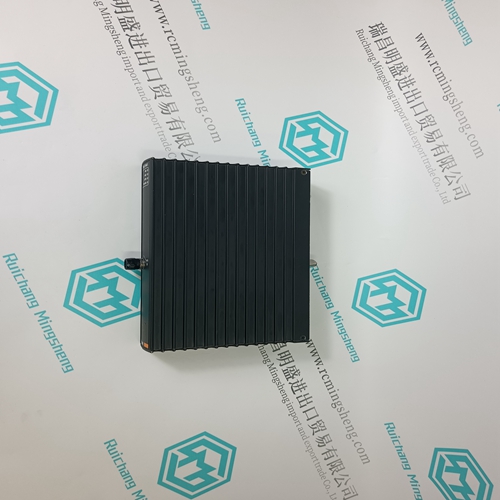

Home > Product > DCS control system > UNS3670A-Z,V2 HIEE205011R0002 Excitation card

UNS3670A-Z,V2 HIEE205011R0002 Excitation card

- Product ID: UNS3670A-Z,V2 HIEE205011R0002

- Brand: ABB

- Place of origin: The Swiss

- Goods status: new/used

- Delivery date: stock

- The quality assurance period: 365 days

- Phone/WhatsApp/WeChat:+86 15270269218

- Email:stodcdcs@gmail.com

- Tags:UNS3670A-ZV2 HIEE205011R0002Excitation card

- Get the latest price:Click to consult

The main products

Spare parts spare parts, the DCS control system of PLC system and the robot system spare parts,

Brand advantage: Allen Bradley, BentlyNevada, ABB, Emerson Ovation, Honeywell DCS, Rockwell ICS Triplex, FOXBORO, Schneider PLC, GE Fanuc, Motorola, HIMA, TRICONEX, Prosoft etc. Various kinds of imported industrial parts

Products are widely used in metallurgy, petroleum, glass, aluminum manufacturing, petrochemical industry, coal mine, papermaking, printing, textile printing and dyeing, machinery, electronics, automobile manufacturing, tobacco, plastics machinery, electric power, water conservancy, water treatment/environmental protection, municipal engineering, boiler heating, energy, power transmission and distribution and so on.

UNS3670A-Z,V2 HIEE205011R0002 Excitation card

General Information Retailers must file a sales tax return for every filing period, even if the retailer made no sales during the period and no tax is due. Typically, returns must be filed on a monthly basis. See Part 7: Filing and Remittance in the Colorado Sales Tax Guide for additional information regarding filing frequency. A separate return must be filed for each business site or location at which a retailer makes sales. If a retailer fails to file a return for any filing period, the Department will estimate the tax due and issue to the retailer a written notice of the estimated tax due. The Department may deactivate the sales tax account of a retailer who fails to file returns for successive filing periods.

Electronic Filing Information

The Department offers multiple electronic filing options that retailers may use as an alternative to filing paper returns. • Revenue Online – Retailers must first create a Revenue Online account to file returns through Revenue Online. Retailers who file returns through Revenue Online must file separate returns for each of the retailer’s business sites or locations. Revenue Online can be accessed at Colorado.gov/RevenueOnline. • XML Filing – Retailers may file returns electronically in an XML (Extensible Markup Language) format using any of the approved software options listed online at Colorado.gov/tax/software-developers-sales-tax-xml. Retailers do not need to obtain any special approval from the Department to file using an approved software option.

Spreadsheet Filing

– Retailers may file electronically using an approved Microsoft Excel spreadsheet. Each retailer must obtain approval from the Department before filing returns with an Excel spreadsheet. Information can be found online at Colorado.gov/tax/sales-tax-spreadsheet-filing. Payment Information The Department offers retailers several payment options for remitting sales taxes. Electronic Payments Regardless of whether they file electronically or with a paper return, retailers can remit payment electronically using one of two payment methods. Retailers who remit electronic payments should check the appropriate box on line 18 of the return to indicate their electronic payment.

• EFT Payment

– Retailers can remit payment by electronic funds transfer (EFT) via either ACH debit or ACH credit. There is no processing fee for EFT payments. Retailers must register prior to making payments via EFT and will not be able to make payments via EFT until 24-48 hours after registering. See Electronic Funds Transferred (EFT) Program For Tax Payments (DR 5782) and Electronic Funds Transfer (EFT) Account Setup For Tax Payments (DR 5785) for additional information. • Credit Card and E-Check – Retailers can remit payment electronically by credit card or electronic check online at Colorado.gov/RevenueOnline. A processing fee is charged for any payments remitted by credit card or electronic check.