Home > Product > Servo control system > YASKAWA CACR-02-TE1K Driver module

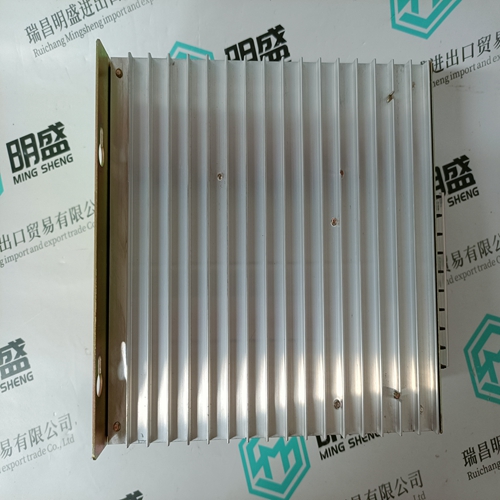

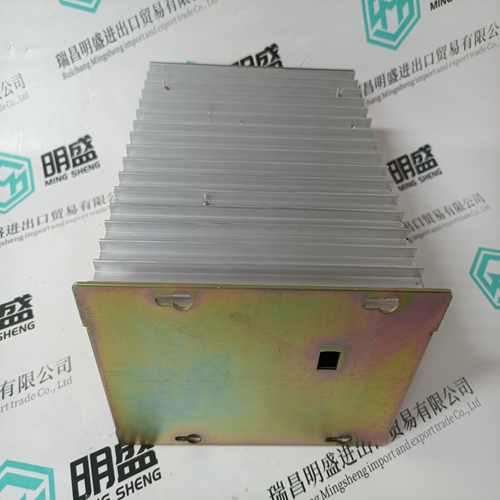

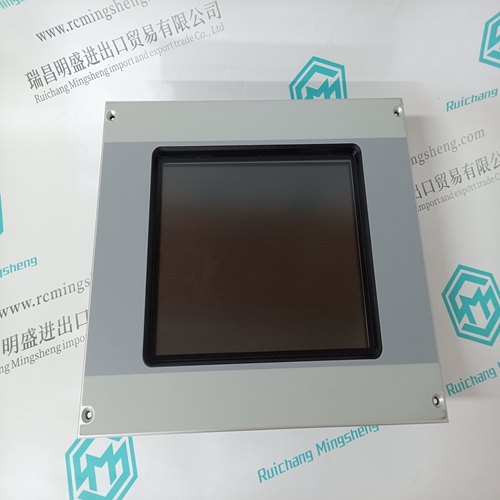

YASKAWA CACR-02-TE1K Driver module

- Product ID: CACR-02-TE1K

- Brand: YASKAWA

- Place of origin: JAPAN

- Goods status: new/used

- Delivery date: stock

- The quality assurance period: 365 days

- Phone/WhatsApp/WeChat:+86 15270269218

- Email:stodcdcs@gmail.com

- Tags:YASKAWA CACR-02-TE1KDriver module

- Get the latest price:Click to consult

The main products

Spare parts spare parts, the DCS control system of PLC system and the robot system spare parts,

Brand advantage: Allen Bradley, BentlyNevada, ABB, Emerson Ovation, Honeywell DCS, Rockwell ICS Triplex, FOXBORO, Schneider PLC, GE Fanuc, Motorola, HIMA, TRICONEX, Prosoft etc. Various kinds of imported industrial parts

Products are widely used in metallurgy, petroleum, glass, aluminum manufacturing, petrochemical industry, coal mine, papermaking, printing, textile printing and dyeing, machinery, electronics, automobile manufacturing, tobacco, plastics machinery, electric power, water conservancy, water treatment/environmental protection, municipal engineering, boiler heating, energy, power transmission and distribution and so on.

YASKAWA CACR-02-TE1K Driver module

Paper Check Regardless of whether they file electronically or with a paper return, retailers can remit payment with a paper check. Retailers should write “Sales Tax,” the account number, and the filing period on any paper check remitted to pay sales tax to ensure proper crediting of their account. • Paper Return – Retailers who file a paper return can mail a paper check with the return to pay the tax reported on the return. • Electronic Filing Through Revenue Online – A retailer who files electronically through Revenue Online can remit payment by paper check. Once the electronic return has been submitted, the retailer can select “Payment Coupon” for the payment option to print a payment processing document to send along with their paper check.

Physical And Non-Physical Sites

A retailer is required to obtain a sales tax license and file separate sales tax returns for each separate place of business at which the retailer makes sales (a “physical site”). Additionally, if a retailer delivers taxable goods or services to a purchaser at any location other than the retailer’s place of business, the retailer must register with the Department a “non-physical site” for each location jurisdiction code into which goods or services are delivered (see Department publication Location/Jurisdiction Codes for Sales Tax Filing (DR 0800) for information about location jurisdiction codes). A “non-physical site” is required for deliveries even if the retailer has a physical site within the same location jurisdiction code. A separate return must be filed for each physical site and each non-physical site. Filing A Paper Return Retailers electing to file a paper return must sign, date, and mail the return, along with their payment, if applicable, to: Colorado Department of Revenue Denver CO 80261-0013 Retailers are required to keep and preserve for a period of three years all books, accounts, and records necessary to determine the correct amount of tax.

Items Removed From Inventory

Any tangible personal property a retailer purchased for resale, but subsequently removed from inventory for the retailer’s own use, is subject to consumer use tax. A Consumer Use Tax Return (DR 0252) is required to report and remit any consumer use tax a retailer owes. Additional Resources Additional sales tax guidance and filing information can be found online at Colorado.gov/tax. These resources include: • Colorado Sales Tax Guide

Form Instructions

In preparing a sales tax return, a retailer must include its identifying information (such as name and account number), the filing period and due date, and information about sales and exemptions in order to calculate the tax due. Specific instructions for preparing sales tax returns appear below and on the following pages. SSN and FEIN Retailers must provide a valid identification number, issued by the federal government, when filing a sales tax return. If the retailer is a corporation, partnership, or other legal entity, this will generally be a Federal Employer Identification Number (FEIN). If the retailer is a sole proprietorship, a Social Security number (SSN) will generally be used instead.