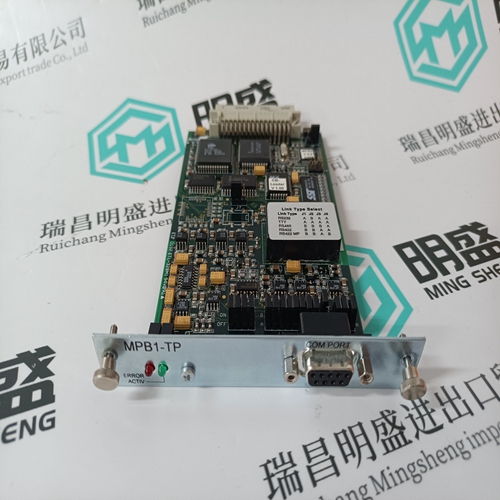

Home > Product > Robot control system > EATON MPB1-TP Spare parts module

EATON MPB1-TP Spare parts module

- Product ID: MPB1-TP

- Brand: EATON

- Place of origin: the United States

- Goods status: new/used

- Delivery date: stock

- The quality assurance period: 365 days

- Phone/WhatsApp/WeChat:+86 15270269218

- Email:stodcdcs@gmail.com

- Tags:EATONMPB1-TPSpare parts module

- Get the latest price:Click to consult

The main products

Spare parts spare parts, the DCS control system of PLC system and the robot system spare parts,

Brand advantage: Allen Bradley, BentlyNevada, ABB, Emerson Ovation, Honeywell DCS, Rockwell ICS Triplex, FOXBORO, Schneider PLC, GE Fanuc, Motorola, HIMA, TRICONEX, Prosoft etc. Various kinds of imported industrial parts

Products are widely used in metallurgy, petroleum, glass, aluminum manufacturing, petrochemical industry, coal mine, papermaking, printing, textile printing and dyeing, machinery, electronics, automobile manufacturing, tobacco, plastics machinery, electric power, water conservancy, water treatment/environmental protection, municipal engineering, boiler heating, energy, power transmission and distribution and so on.

EATON MPB1-TP Spare parts module

Colorado Account Number Retailers must enter their Colorado account number on each return, including both their eight-digit account number and the four-digit site/location number (for example: 12345678-0001). If a retailer makes sales at different locations, the retailer must file a separate return for each location. Returns must also be filed for each location jurisdiction code area into which the retailer makes deliveries during the tax period. The eightdigit account number will be the same for each location or site, but the four-digit site/location number will be unique for each location or site. If you have applied for your license, but do not have your account number, please contact the Customer Contact Center at (303) 238-7378 for assistance.

Period Retailers must indicate the filing period for each return. The filing period is defined by the first and last months in the filing period and entered in a MM/YY-MM/YY format. For example: • For a monthly return for January 2020, the filing period would be 01/20-01/20. • For a quarterly return for the first quarter (Jan. through March) of 2020, the filing period would be 01/20-03/20. • For an annual return filed for 2020, the filing period would be 01/20-12/20.

Location Juris Code

Retailers must enter the six-digit location jurisdiction (juris) code to identify the site/location of sales reported on the return. For physical site/locations, the code appears on the retailer’s Sales Tax License under 'Liability Information.' A complete listing of location juris codes can be found in Department publication Location/Jurisdiction Codes for Sales Tax Filing (DR 0800). Due Date Retailers must enter the due date for the return. Returns are due the 20th day of the month following the close of the filing period. If the 20th is a Saturday, Sunday, or legal holiday, the return is due the next business day

Amended Returns

If a retailer is filing a return to amend a previously filed return, the retailer must mark the applicable box to indicate that the return is an amended return. A separate amended return must be filed for each filing period and for each site/location. The amended return replaces the original return in its entirety and must report the full corrected amounts, rather than merely the changes in the amount of sales or tax due. If the amended return reduces the amount of tax reported on the original return, the retailer must file a Claim for Refund (DR 0137) along with the amended return to request a refund of the overpayment. If the amended return is filed after the due date and reports an increase in the amount of tax due, penalties and interest will apply

State and State-Collected Local Sales Taxes

The Colorado Retail Sales Tax Return (DR 0100) is used to report not only Colorado sales tax, but also sales taxes administered by the Colorado Department of Revenue for various cities, counties, and special districts in the state. The sales taxes for different local jurisdictions are calculated and reported in separate columns of the DR 0100. Local sales taxes reported on the DR 0100 include: • RTD/CD – Sales taxes for the Regional Transportation District (RTD) and the Scientific and Cultural Facilities District (CD) are reported in the RTD/CD column of the DR 0100. • Special District – Special district sales taxes reported in the Special District column include sales taxes for any Regional Transportation Authority (RTA), MultiJurisdictional Housing Authority (MHA), Public Safety Improvements (PSI), Metropolitan District Tax (MDT), or Health Services District (HSD). Sales taxes for Mass Transportation Systems (MTS) and Local Improvement Districts (LID) are not reported in the Special District column, but are instead reported in the County/MTS and City/LID columns, respectively.