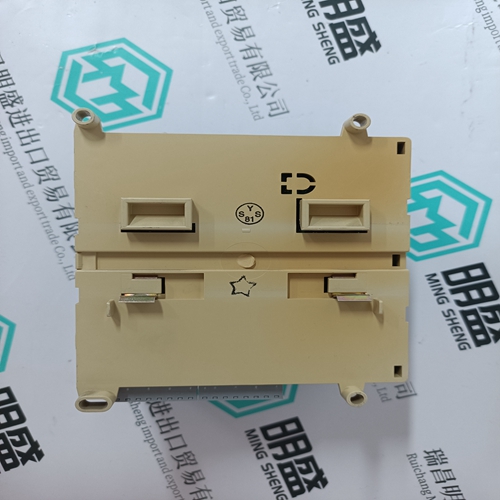

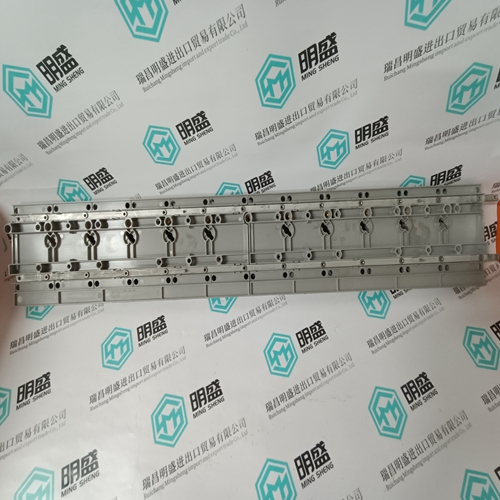

Home > Product > DCS control system > GJR5252300R3101 07AC91F Industrial control module

GJR5252300R3101 07AC91F Industrial control module

- Product ID: GJR5252300R3101 07AC91F

- Brand: ABB

- Place of origin: The Swiss

- Goods status: new/used

- Delivery date: stock

- The quality assurance period: 365 days

- Phone/WhatsApp/WeChat:+86 15270269218

- Email:stodcdcs@gmail.com

- Tags:GJR5252300R3101 07AC91FIndustrial control module

- Get the latest price:Click to consult

The main products

Spare parts spare parts, the DCS control system of PLC system and the robot system spare parts,

Brand advantage: Allen Bradley, BentlyNevada, ABB, Emerson Ovation, Honeywell DCS, Rockwell ICS Triplex, FOXBORO, Schneider PLC, GE Fanuc, Motorola, HIMA, TRICONEX, Prosoft etc. Various kinds of imported industrial parts

Products are widely used in metallurgy, petroleum, glass, aluminum manufacturing, petrochemical industry, coal mine, papermaking, printing, textile printing and dyeing, machinery, electronics, automobile manufacturing, tobacco, plastics machinery, electric power, water conservancy, water treatment/environmental protection, municipal engineering, boiler heating, energy, power transmission and distribution and so on.

GJR5252300R3101 07AC91F Industrial control module

Line 8. Excess tax collected Enter any tax collected in excess of the tax due as computed on line 7. For example, if the retailer collected $50 of county sales tax during the filing period, but only $45 of tax is calculated in the County/MTS column of the return, the excess $5 of tax collected must be reported on this line. Line 10. Service fee rate Enter the applicable service fee rate in each column of the return. The Colorado state service fee rate is 4%. Service fee rates for each city, county, and special district can be found in Department publication Colorado Sales/Use Tax Rates (DR 1002). Line 11. Service fee The service fee is calculated by multiplying the amount on line 9 by the rate on line 10. The full amount calculated should be entered on line 11, unless the return is filed after the due date or possibly if the return is an amended return. Both of these situations are addressed in the following instructions.

Timely payment of tax

If the tax calculated on the return is paid by the return due date, enter on line 11 the service fee calculated by multiplying the amount on line 9 by the service fee rate on line 10, regardless of whether the return is an original or amended return. If the return is an original return and the tax is not paid by the due date for the return, and therefore no service fee is allowed, enter $0 on line 11. Amended returns If the return is an amended return and the tax reported on the original return was not paid by the due date for the return, the allowable service fee on the amended return is $0. If the tax reported on the original return was paid by the due date and the amended return reports an increase of the tax due, the allowable service fee on the amended return is equal to the service fee allowed on the original return. Enter on line 11 of the amended return the service fee allowed on the original return. No additional service fee is allowed for the additional tax reported on the amended return. If the tax reported on the original return was paid by the due date and the amended returns reports a decrease of the tax due, enter on line 11 the amount calculated by multiplying the amount on line 9 of the amended return by the service fee rate on line 10.

Limit on state service fee

The total combined Colorado state service fee allowed to a retailer for any given filing period is limited to $1,000. The retailer should enter on line 11 the full amount calculated by multiplying the amount on line 9 times the rate on line 10, but if the combined Colorado state service fee calculated on the retailer’s sales tax returns for all sites/locations for the filing period exceeds $1,000, the retailer must complete the State Service Fee Worksheet (DR 0103). The worksheet is used to determine what amount, if any, the retailer must pay in addition to the total balance due calculated on line 18 of the retailer’s returns. The amount of additional tax calculated on the State Service Fee Worksheet (DR 0103) should not be entered anywhere on the retailer’s Colorado Retail Sales Tax Return (DR 0100).

Line 13. Credit for tax previously paid

If a retailer overpaid tax on any previously filed return for a different filing period, and a refund claim for such overpayment is not barred by the statute of limitations, the retailer may claim a credit against tax calculated on the current return for such prior overpayment. Credit may be claimed only for tax overpayments for the same site/location and the same state or local jurisdiction. No credit may be claimed for an overpayment reflected in Department records either because the retailer filed an amended return or the Department adjusted the tax for the prior filing period.